Ballot Issue 1A: FAQ's

Frequently Asked Questions (FAQ’s)

Issue 1A outlines a multi-pronged strategy to the creation of new affordable homes in towns and communities throughout Eagle County. Passage of Issue 1A will help keep locals local by allowing individuals and families in stay in Eagle County through improved access to housing.

Q: Why do we need a funding source for affordable workforce housing?

A: We have a significant housing problem. We need 4.500 housing units today and will need a total of 12,000 by 2025 to house our workforce. (source: Eagle County Housing Needs Assessment). As housing prices increase far faster than area wages, our resort brands create an international demand for limited housing stock, and high land prices make free-market development of affordable units financially unviable to developers.

Q: What is the definition of affordable housing and whom will it serve?

Housing is considered affordable to a household if it costs no more than 30% of a household’s income. Household income is typically shown as a percentage of the Area Median Income (AMI). At 100% of AMI, our current affordability gap is $234,310; even at 140% of AMI, our affordability gap is $97,600. As a result, affordable housing will serve a large portion of our working class population.

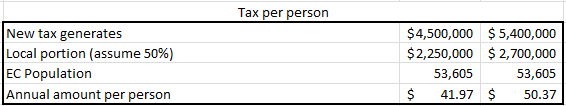

Q: How much will this cost? How much will it raise?

A: 1A is asking for approval for a 3/10 sales tax – that’s $0.03 sales tax on every $10 purchase (exempting groceries). It is estimated to raise up to $5,400,000 per year to help address our housing issues.

Depending upon how much we anticipate the tax generating – between $4.5 million to the high estimate of $5.4 million, and assuming 50% of the tax is paid by visitors, we estimate it will cost local taxpayers between $42 and $50 per year.

Q: Who will this benefit?

A: We are all touched by Eagle County’s affordable workforce housing crisis. Affordable workforce housing benefits the entire community. Businesses benefit through increased employee retention and recruiting. Employees benefit through more affordable living situations. Individuals benefit through home ownership tax credits. Communities benefit through the creation of year-round residents and the ability to have police, fire fighters, teachers, nurses, and other professionals live closer to work.

Q: Why is this a problem now?

A: Housing costs threaten our business community. In fact, 69% of business operators indicate that the housing situation negatively impacts their ability to hire and retain employees and this issue is mentioned frequently when asked about additional resources that are needed. (Source: 2016 Eagle County Workforce Study). There is a point at which our businesses will be unable to expand because they will not be able to fill the jobs needed to grow. There is a cost to not building workforce housing.

Q: How will this money be used?

A: There’s no silver bullet solution to our housing crisis; as a result, 1A will allow for a variety of uses including new construction of deed restricted housing for owners (i.e., Miller Ranch), deed restricted housing housing for renters, down payment assistance programs, public-private partnerships with developers, unit buy-downs and adding deed restrictions to existing properties, land banking, and more. We need to find any tool we can use to put more units into the long-term housing pool.

Q: What are current vacancy rates?

A: Apartment vacancy rates are near zero (source: Polar Star Properties) and the affordability gap on free-market homes exceeds $234,000 for a standard family at 100% of the area median income (source: Eagle County Housing Needs Assessment).

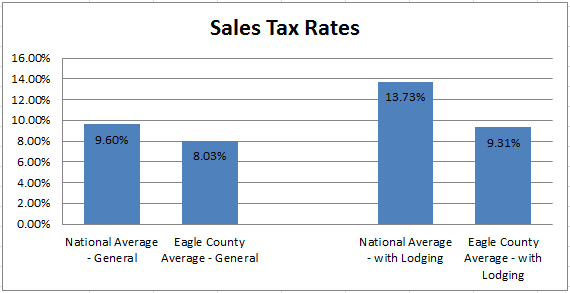

Q: How do our current taxes compare to the national average?

A: 1A would increase our sales tax by 0.03% (three cents on ten dollars, exempting groceries). Five states do not have statewide sales tax. The lowest non-zero state-level sales tax is in Colorado, at 2.9%. All other states have higher state sales taxes. Combining state and local taxes, Colorado’s average sales tax is 7.5%, ranking 16th in the nation. Eagle County’s average sales tax is lower (and will remain lower with the passage of 1A) than other mountain resort communities including Grand, Gunnison, and Pitkin and is slightly higher than Summit and Route County. We remain well below the national average:

Q: Won’t this just increase our cost of living, increasing the cost to live in Eagle County?

A: A sales tax of three cents on every ten dollars is estimated to cost the average family approximately $150 per year ($42-50 per person) and exempts grocery sales. Of course, much of our sales tax is collected from visitors and second homeowners. Local wages have increased, but not at the same level as real estate appreciation, leading to increased affordability gap in home prices. 1A creates an opportunity to keep locals local, create more workforce to fill local jobs, helping businesses and entrepreneurs to succeed in Eagle County. Increasing affordable housing options will work lower the overall cost of living because the number of cost burdened families will decrease.

Q: Who is in charge of the funds?

A: As a county-wide sales tax, the ultimate authority for use of the funds lies with the elected Board of County Commissioners. This is similar to the Eco-Transit/Eco-Trails and Open Space funding models, both of which utilize a citizen advisory board to provide guidance and feedback to the elected officials.

Q: What are other resort communities doing?

A: A lot! Aspen, Boulder, Mountain Village, Summit County, and Telluride all have sales taxes in place for affordable workforce housing. Boulder also has a property tax and development excise. Aspen also has a real estate transfer tax, and numerous counties and cities have additional housing impact fees. Summit County, for example, has seen great success in a short time and provides a good model for Eagle County:

Q: How will we know if we are successful?

A: The number of businesses saying housing is a significant problem for their employees will decrease, and the number of cost burdened families will decrease. We can also measure the use of down payment assistance programs, land banking, unit buy-downs, increase in affordable rental units, and public-private partnerships.

Hear from the Vail Valley Businesses

Member Minute: Drew

SpringHill & TownePlace Suites Avon